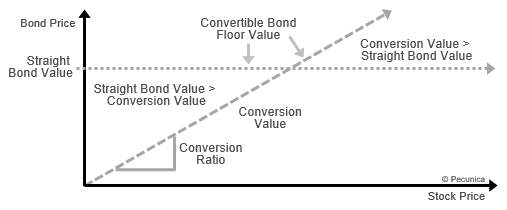

Floor Value Convertible Bond

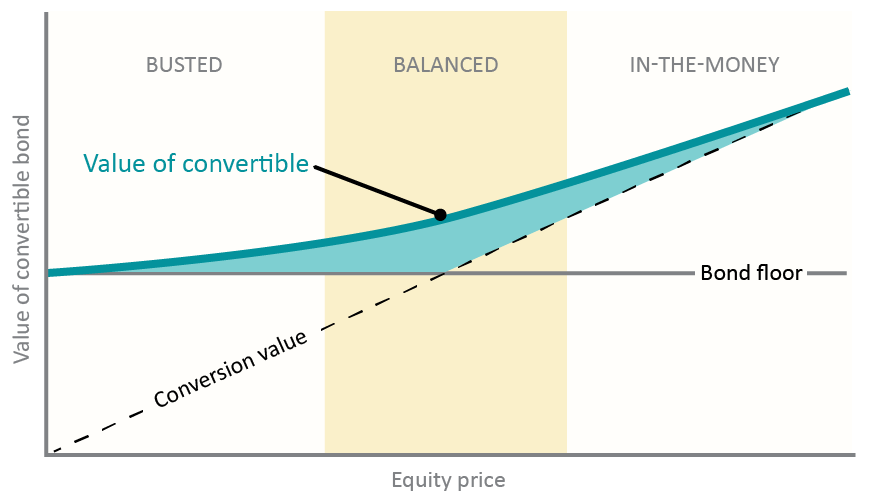

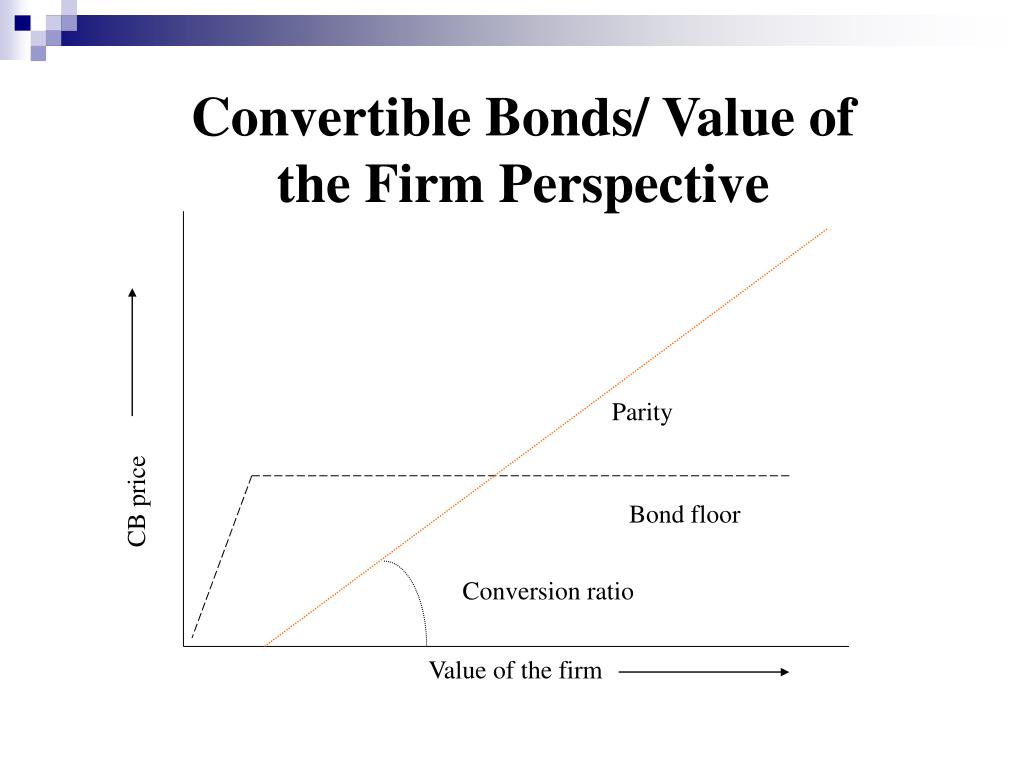

It should trade for at least its floor value regardless of how low the stock drops.

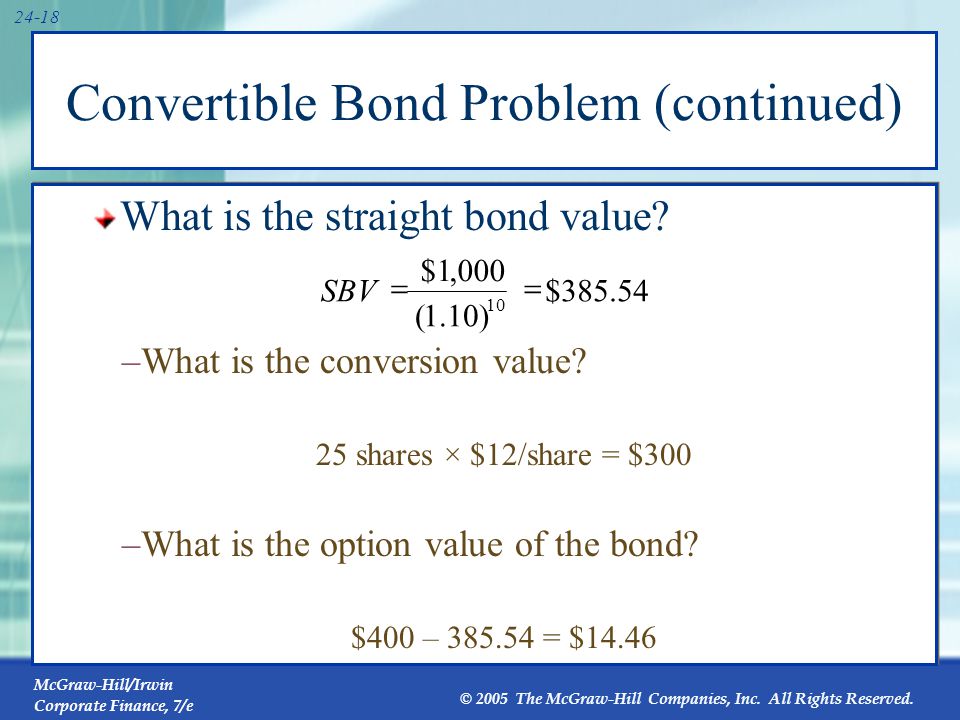

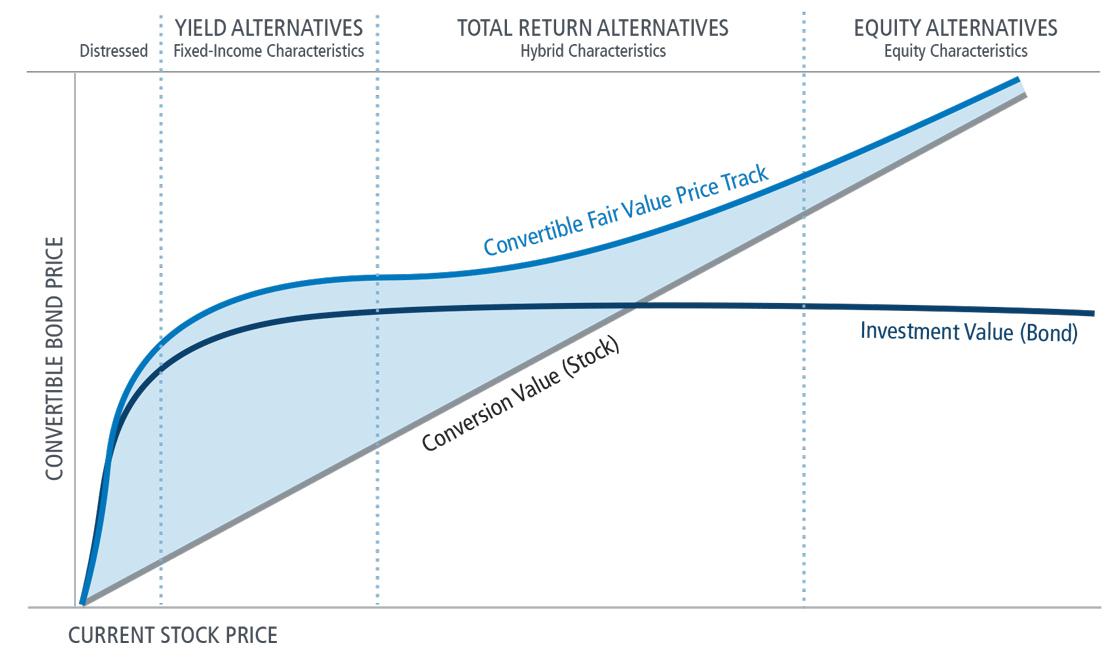

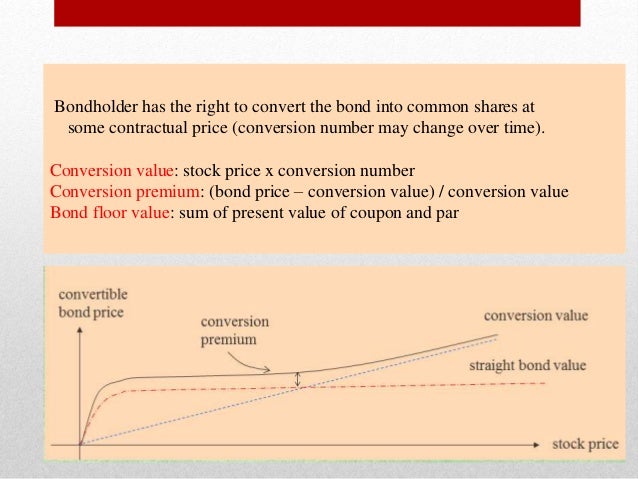

Floor value convertible bond. The bond floor is the value at which the. Convertible bonds are safer than preferred or common shares for the investor. Conversion premium current bond price max cv bv where cv stands for conversion value and bv stands for bond value without the conversion feature i e. Convertible bonds are a hybrid debt instrument issued by a corporation that can be converted to common stock at the discretion of the bondholder or the corporation once certain price thresholds are achieved.

While the rewards are not as great the risks are less. The convertible bond will outperform the company s stock when the stock declines in value because the convertible has a price floor equal to the straight bond value. It is calculated assuming that the holders take cash on redemption rather than convert. Convertible bonds can be an option for those who want to invest in the stock market but are worried about losing money.

Usually bond holders will be expecting to convert because they are expecting that the shares will be worth more than the cash alternative and so you would usually expect the actual market value to be higher than the floor value. Example of a convertible bond. Convertible bonds have a floor value which makes it very unlikely the investor will lose money on them. They provide asset protection because the value of the convertible bond will only fall to the value of the bond floor.

As an example let s say exxon mobil corp. The value of a straight bond. The value of these payments represents a convertible bond s floor or minimum value. Issued a convertible bond with a 1 000 face value that pays 4 interest.

The convertible bond will underperform the company s stock when the stock appreciates significantly because the investor paid a conversion premium on the convertible bond. To estimate the bond investment value one has to determine the required yield on a non convertible bond. However in reality if stock price falls too much the credit spread will increase and the price of the bond will go below the bond floor. The bond has a maturity of 10 years and a.

It is the lowest market value that the bond can have. The floor value of the convertible bond is the lowest value to which the bond can drop and the point at which the conversion option. A technology company issued 100 million in convertible bonds on 1 january 20x1 with a maturity date of 31 december 20y5.