Floor Value Of Convertible Bond Calculation

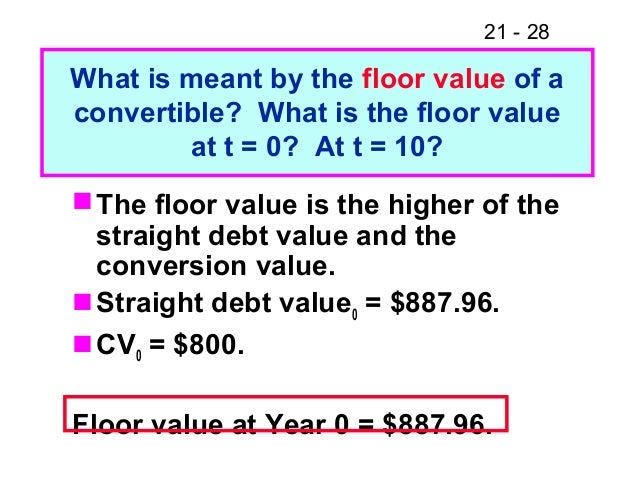

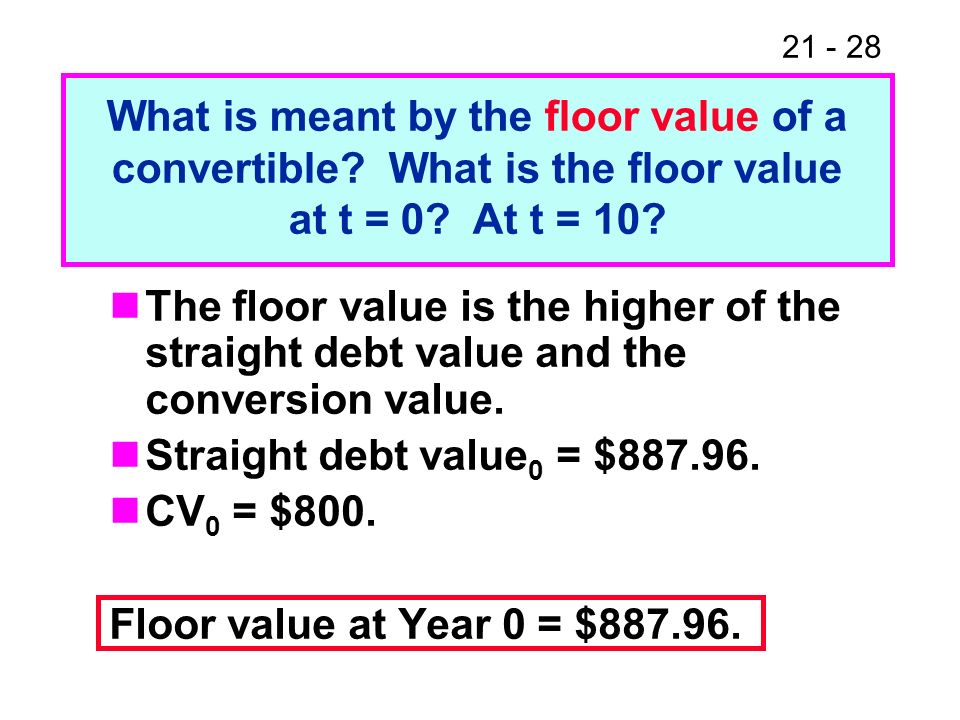

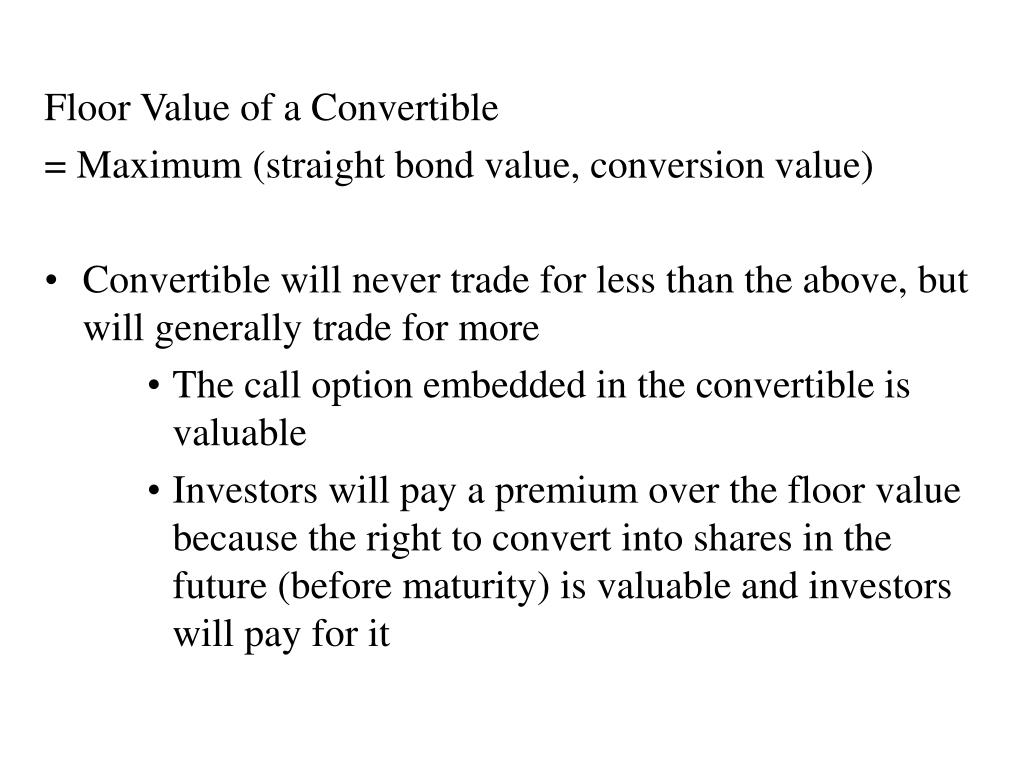

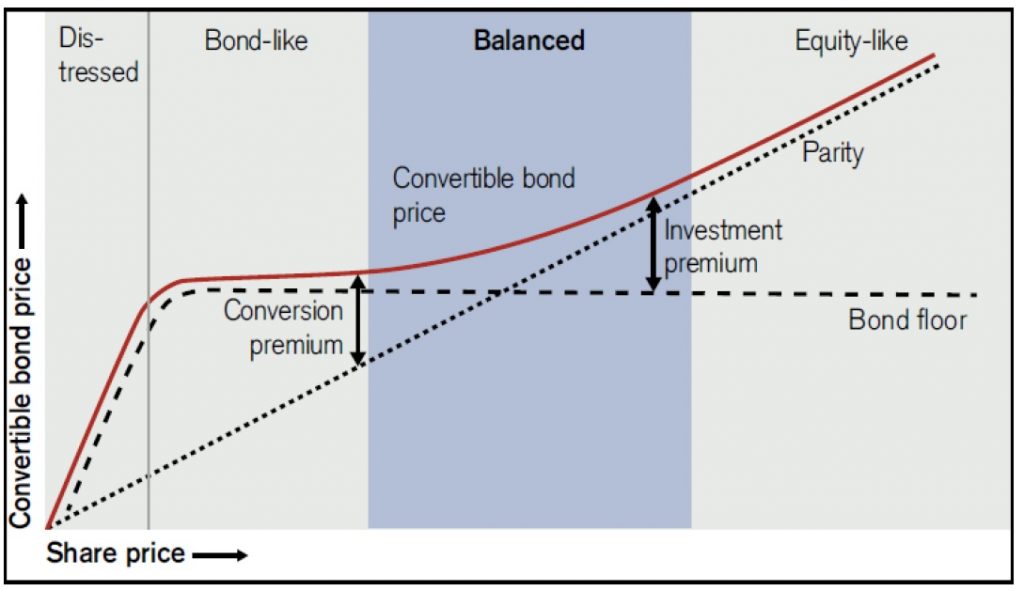

Usually bond holders will be expecting to convert because they are expecting that the shares will be worth more than the cash alternative and so you would usually expect the actual market value to be higher than the floor value.

Floor value of convertible bond calculation. Divide the convertible bond s face value by your step 5 result and add this calculation s result to your step 8 result to figure the bond s floor value. The last date of conversion is 31 december 20y0. The bond floor is the value at which the. If the stock value of your convertible bond is dropping you won t be able to convert the bond to stock.

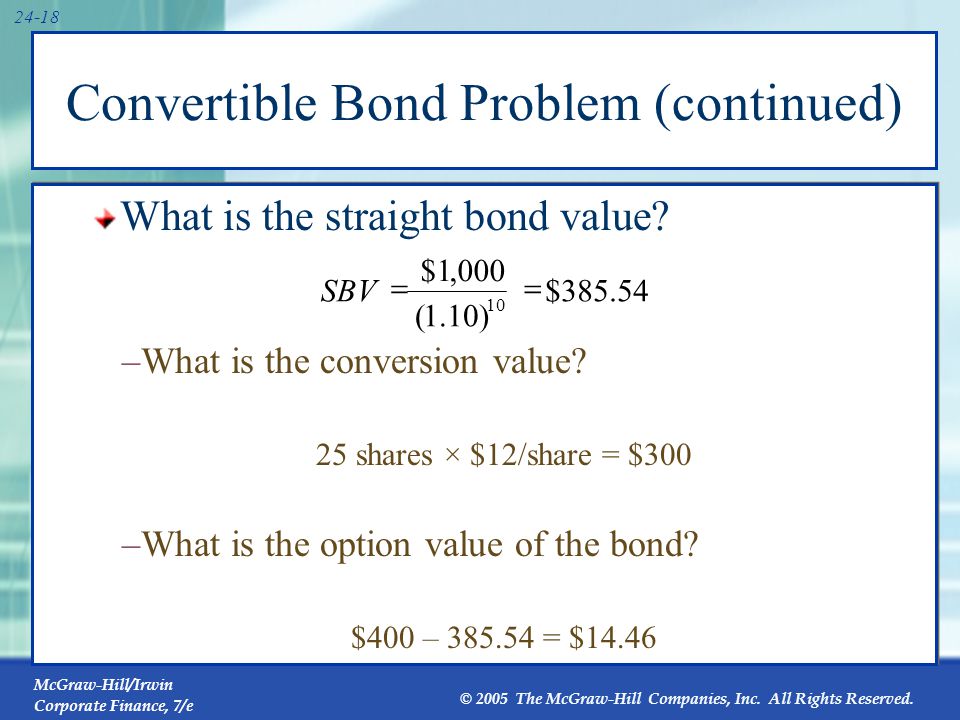

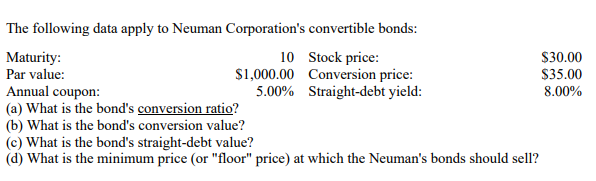

To estimate the bond investment value one has to determine the required yield on a non convertible bond. Where cv stands for conversion value and bv stands for bond value without the conversion feature i e. The lowest value that convertible bonds can fall to given the present value of the remaining future cash flows and principal repayment. Bond investment value value as a corporate bond without the conversion option based on the convertible bond s cash flow if not converted.

But your profit will still be the bond s yield. The convertible bond will underperform the company s stock when the stock appreciates significantly because the investor paid a conversion premium on the convertible bond. It is the lowest market value that the bond can have. You will receive your principal on a specified maturity date.

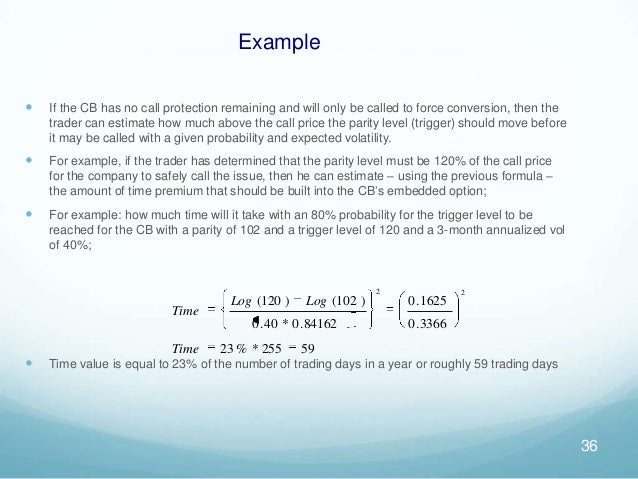

The floor value of the convertible bond is the lowest value to which the bond can drop and the point at which the conversion option becomes worthless. Floor value the floor value of a convertible bond is the greater of 1. A technology company issued 100 million in convertible bonds on 1 january 20x1 with a maturity date of 31 december 20y5. Concluding the example divide 1 000.

The convertible bond will outperform the company s stock when the stock declines in value because the convertible has a price floor equal to the straight bond value. Convertibles are a category of financial instruments such as. It is calculated assuming that the holders take cash on redemption rather than convert. The value of a straight bond.

:max_bytes(150000):strip_icc()/GettyImages-160519027-458287b2fbec405e85c38510953507ad.jpg)