Flooring Capital Or Revenue Expenditure

The same goes for extensive new plumbing or major electrical work.

Flooring capital or revenue expenditure. Self assessment and company tax returns 2015 to 2016 has been added to the page. Repair replacement of small parts of an existing structure structure. Capital revenue roofs structure. Taking the flooring example new flooring is ofcourse improving the asset and therefore by this definition it is capital exp.

Maintaining the house at 500 000 is revenue. Categorizing an expenditure as either maintenance or as a capital expenditure or improvement is a careful decision that should be made each time any type of maintenance repair or renovations are performed. An it contractor might need a laptop to do his work but it would still be a capital item. Previous page next page.

Anything done to maintain the capital fund is revenue. But you can also argue that new flooring is replacing the old therefore this is not an improvement but merely returning the asset back to its previous condition so therefore as it is a repair it is revenue expenditure. New not replacement structure. For example the cost of putting vinyl siding on the exterior walls of a wooden property is a capital expense.

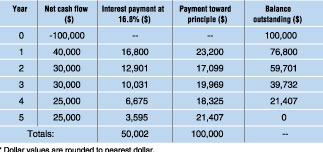

Suppose the original fund is 500 000 pounds i e. Renovations and expenses that extend the useful life of your property or improve it beyond its original condition are usually capital expenses. Examples of capital revenue expenditure the following indicative table is provided to assist in determining how some examples of commonly incurred premises expenditure might be treated. Agent toolkit for capital v revenue expenditure updated for.

Capital or revenue i like to proceed on an economic basis. In order to obtain cgt relief the purpose of the expenditure needs to be to enhance the value of the asset and needs to be reflected in the state of the asset at the time of disposal s 38 1 b tcga 1992. A capital expense generally gives a lasting benefit or advantage. Please contact a capital allowances technical adviser in business assets and international bai before accepting that expenditure on floors qualifies in part.

Capital v revenue expenditure toolkit. As discussed in the previous article just because something is required for the business doesn t mean it is deductible as a revenue expense. A capital expenditure could also include installing a new heating and air conditioning system or doing a major overhaul of an existing hvac system. To get it right consider the value of the asset the intended goal of the work to be performed the scope of work the actual result and.

The revenue capital distinction is less relevant for cgt purposes. In that case any expenditure must be an improvement even if it is essential to the letting business.

:max_bytes(150000):strip_icc()/TeslaCFSme2020Q2-d3cf30eeb0d64b81b66510f59d9d7764.jpg)